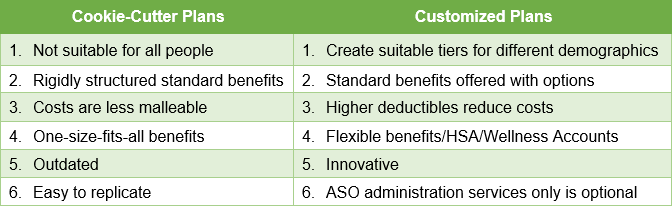

Cookie-cutter plans are precisely that, they are the same style, one-size-fits-all, of benefits for all eligible employees. Employees, at any age and of any health, receive the same benefits package. The pricing of these benefits is not always the most affordable option, nor is it always the most comprehensive plan for all the demographics within a company. With the baby boomers requiring more coverage for medications, typically the cost can be ridiculous. So much so that putting a plan in place may seem like a daunting mission and an unwarranted expense.

Millennials have requirements, unlike medications. They are looking for choices. In plenty of cases, the standard cookie-cutter plan is not a fit for them. Nevertheless, they are helping to fund the overall costs of benefits for the older members. It is like equally splitting the restaurant bill when you only ordered the side salad. Millennials find that several of the traditional offerings will remain unused. For instance, private duty nursing is on many cookie-cutter plans. In my 28 years of working in this industry, I have never used it or helped someone get this benefit paid. Cookie-cutter plans are the norm, and it is time we replace them with an updated model.

Customized plans are what we do to assist clients in tailoring a benefits plan that is suited to their business and demographics. We assist clients with redesigning their benefits. We learn about the specific group and create tiers of coverage. We do this by working closely with the decision makers to design a plan that will be sustainable and cost-effective for everyone. We take all the parties involved into consideration. We also look for sustainability within the group, so there is not much moving from one carrier to another. Often one carrier may not have all the components that are necessary to create a strong, cohesive benefits plan. We collaborate with many providers to structure cost-saving measures for the business owner and the employees involved.

Health Spending Accounts (HSAs) and Wellness Accounts are becoming extremely popular. These offer better choices to all members. Restructuring dental to help cover the higher cost items or procedures is increasing. Ever thought that group benefits should cover Major Dental and Basic Dental completely differently? We can assist with that. Paramedical services are on the rise, as individuals are looking for ways to take care of themselves before a disability occurs. Customized plans are growing, and this is where group benefits are going in the future, as the standard is changing.

Let us help you create some unique and affordable options. Give us a call!

Also, check out our blog, to learn more about the innovative benefits options we can help you implement for your employees.

Have a question? Or need clarification?

Call to schedule an appointment with one of our advisors.